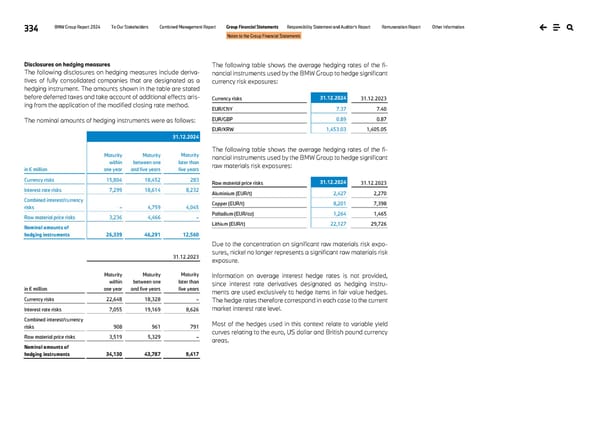

334 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Disclosures on hedging measures The following disclosures on hedging measures include deriva- tives of fully consolidated companies that are designated as a hedging instrument. The amounts shown in the table are stated before deferred taxes and take account of additional effects aris- ing from the application of the modified closing rate method. The nominal amounts of hedging instruments were as follows: 31.12.2024 in € million Maturity within one year Maturity between one and five years Maturity later than five years Currency risks 15,804 18,452 283 Interest rate risks 7,299 18,614 8,232 Combined interest/currency risks – 4,759 4,045 Raw material price risks 3,236 4,466 – Nominal amounts of hedging instruments 26,339 46,291 12,560 31.12.2023 in € million Maturity within one year Maturity between one and five years Maturity later than five years Currency risks 22,648 18,328 – Interest rate risks 7,055 19,169 8,626 Combined interest/currency risks 908 961 791 Raw material price risks 3,519 5,329 – Nominal amounts of hedging instruments 34,130 43,787 9,417 The following table shows the average hedging rates of the fi- nancial instruments used by the BMW Group to hedge significant currency risk exposures: Currency risks 31.12.2024 31.12.2023 EUR/CNY 7.37 7.40 EUR/GBP 0.89 0.87 EUR/KRW 1,453.03 1,405.05 The following table shows the average hedging rates of the fi- nancial instruments used by the BMW Group to hedge significant raw materials risk exposures: Raw material price risks 31.12.2024 31.12.2023 Aluminium (EUR/t) 2,427 2,270 Copper (EUR/t) 8,201 7,398 Palladium (EUR/oz) 1,264 1,465 Lithium (EUR/t) 22,127 29,726 Due to the concentration on significant raw materials risk expo- sures, nickel no longer represents a significant raw materials risk exposure. Information on average interest hedge rates is not provided, since interest rate derivatives designated as hedging instru- ments are used exclusively to hedge items in fair value hedges. The hedge rates therefore correspond in each case to the current market interest rate level. Most of the hedges used in this context relate to variable yield curves relating to the euro, US dollar and British pound currency areas.

BMW Group Report 2024 Page 333 Page 335

BMW Group Report 2024 Page 333 Page 335