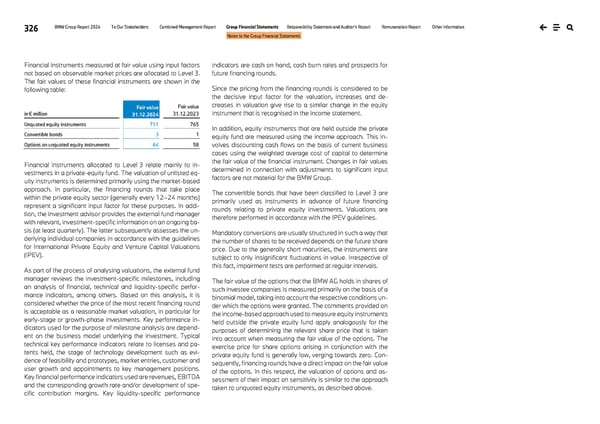

326 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Financial instruments measured at fair value using input factors not based on observable market prices are allocated to Level 3. The fair values of these financial instruments are shown in the following table: in € million Fair value 31.12.2024 Fair value 31.12.2023 Unquoted equity instruments 711 765 Convertible bonds 3 1 Options on unquoted equity instruments 64 58 Financial instruments allocated to Level 3 relate mainly to in- vestments in a private-equity fund. The valuation of unlisted eq- uity instruments is determined primarily using the market-based approach. In particular, the financing rounds that take place within the private equity sector (generally every 12–24 months) represent a significant input factor for these purposes. In addi- tion, the investment advisor provides the external fund manager with relevant, investment-specific information on an ongoing ba- sis (at least quarterly). The latter subsequently assesses the un- derlying individual companies in accordance with the guidelines for International Private Equity and Venture Capital Valuations (IPEV). As part of the process of analysing valuations, the external fund manager reviews the investment-specific milestones, including an analysis of financial, technical and liquidity-specific perfor- mance indicators, among others. Based on this analysis, it is considered whether the price of the most recent financing round is acceptable as a reasonable market valuation, in particular for early-stage or growth-phase investments. Key performance in- dicators used for the purpose of milestone analysis are depend- ent on the business model underlying the investment. Typical technical key performance indicators relate to licenses and pa- tents held, the stage of technology development such as evi- dence of feasibility and prototypes, market entries, customer and user growth and appointments to key management positions. Key financial performance indicators used are revenues, EBITDA and the corresponding growth rate and/or development of spe- cific contribution margins. Key liquidity-specific performance indicators are cash on hand, cash burn rates and prospects for future financing rounds. Since the pricing from the financing rounds is considered to be the decisive input factor for the valuation, increases and de- creases in valuation give rise to a similar change in the equity instrument that is recognised in the income statement. In addition, equity instruments that are held outside the private equity fund are measured using the income approach. This in- volves discounting cash flows on the basis of current business cases using the weighted average cost of capital to determine the fair value of the financial instrument. Changes in fair values determined in connection with adjustments to significant input factors are not material for the BMW Group. The convertible bonds that have been classified to Level 3 are primarily used as instruments in advance of future financing rounds relating to private equity investments. Valuations are therefore performed in accordance with the IPEV guidelines. Mandatory conversions are usually structured in such a way that the number of shares to be received depends on the future share price. Due to the generally short maturities, the instruments are subject to only insignificant fluctuations in value. Irrespective of this fact, impairment tests are performed at regular intervals. The fair value of the options that the BMW AG holds in shares of such investee companies is measured primarily on the basis of a binomial model, taking into account the respective conditions un- der which the options were granted. The comments provided on the income-based approach used to measure equity instruments held outside the private equity fund apply analogously for the purposes of determining the relevant share price that is taken into account when measuring the fair value of the options. The exercise price for share options arising in conjunction with the private equity fund is generally low, verging towards zero. Con- sequently, financing rounds have a direct impact on the fair value of the options. In this respect, the valuation of options and as- sessment of their impact on sensitivity is similar to the approach taken to unquoted equity instruments, as described above.

BMW Group Report 2024 Page 325 Page 327

BMW Group Report 2024 Page 325 Page 327