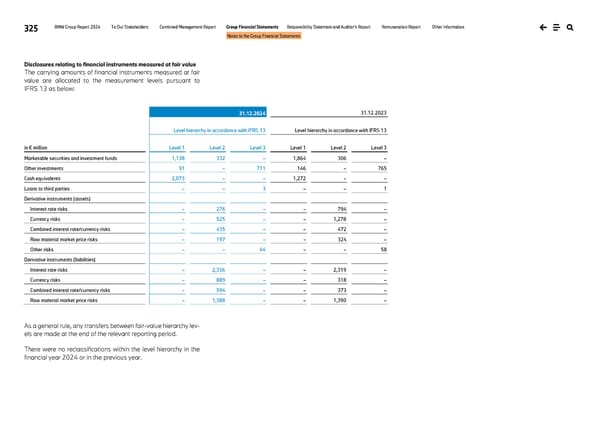

325 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Disclosures relating to financial instruments measured at fair value The carrying amounts of financial instruments measured at fair value are allocated to the measurement levels pursuant to IFRS 13 as below: 31.12.2024 31.12.2023 Level hierarchy in accordance with IFRS 13 Level hierarchy in accordance with IFRS 13 in € million Level 1 Level 2 Level 3 Level 1 Level 2 Level 3 Marketable securities and investment funds 1,138 332 – 1,864 306 – Other investments 91 – 711 146 – 765 Cash equivalents 2,073 – – 1,272 – – Loans to third parties – – 3 – – 1 Derivative instruments (assets) Interest rate risks – 276 – – 794 – Currency risks – 525 – – 1,278 – Combined interest rate/currency risks – 435 – – 472 – Raw material market price risks – 197 – – 324 – Other risks – – 64 – – 58 Derivative instruments (liabilities) Interest rate risks – 2,336 – – 2,319 – Currency risks – 889 – – 318 – Combined interest rate/currency risks – 594 – – 373 – Raw material market price risks – 1,388 – – 1,390 – As a general rule, any transfers between fair-value hierarchy lev- els are made at the end of the relevant reporting period. There were no reclassifications within the level hierarchy in the financial year 2024 or in the previous year.

BMW Group Report 2024 Page 324 Page 326

BMW Group Report 2024 Page 324 Page 326