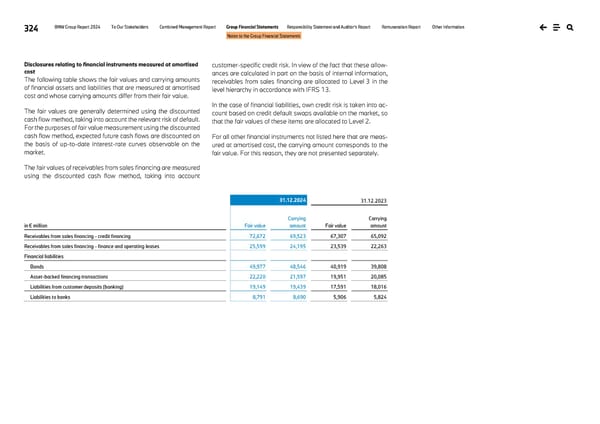

324 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Disclosures relating to financial instruments measured at amortised cost The following table shows the fair values and carrying amounts of financial assets and liabilities that are measured at amortised cost and whose carrying amounts differ from their fair value. The fair values are generally determined using the discounted cash flow method, taking into account the relevant risk of default. For the purposes of fair value measurement using the discounted cash flow method, expected future cash flows are discounted on the basis of up-to-date interest-rate curves observable on the market. The fair values of receivables from sales financing are measured using the discounted cash flow method, taking into account customer-specific credit risk. In view of the fact that these allow- ances are calculated in part on the basis of internal information, receivables from sales financing are allocated to Level 3 in the level hierarchy in accordance with IFRS 13. In the case of financial liabilities, own credit risk is taken into ac- count based on credit default swaps available on the market, so that the fair values of these items are allocated to Level 2. For all other financial instruments not listed here that are meas- ured at amortised cost, the carrying amount corresponds to the fair value. For this reason, they are not presented separately. 31.12.2024 31.12.2023 in € million Fair value Carrying amount Fair value Carrying amount Receivables from sales financing - credit financing 72,672 69,523 67,307 65,092 Receivables from sales financing - finance and operating leases 25,599 24,195 23,539 22,263 Financial liabilities Bonds 49,977 48,546 40,919 39,808 Asset-backed financing transactions 22,220 21,597 19,951 20,085 Liabilities from customer deposits (banking) 19,149 19,439 17,591 18,016 Liabilities to banks 8,791 8,690 5,906 5,824

BMW Group Report 2024 Page 323 Page 325

BMW Group Report 2024 Page 323 Page 325