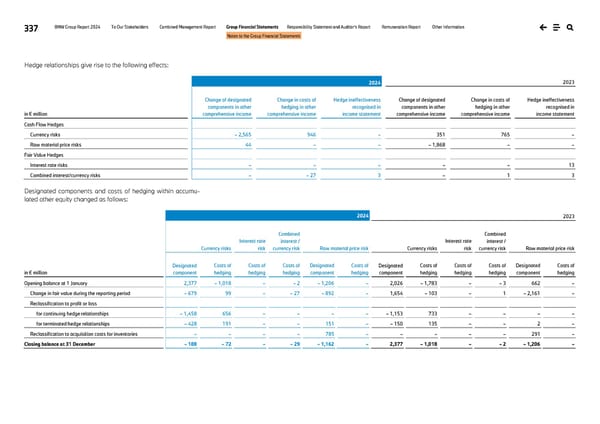

337 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Hedge relationships give rise to the following effects: 2024 2023 in € million Change of designated components in other comprehensive income Change in costs of hedging in other comprehensive income Hedge ineffectiveness recognised in income statement Change of designated components in other comprehensive income Change in costs of hedging in other comprehensive income Hedge ineffectiveness recognised in income statement Cash Flow Hedges Currency risks – 2,565 946 – 351 765 – Raw material price risks 44 – – – 1,868 – – Fair Value Hedges Interest rate risks – – – – – 13 Combined interest/currency risks – – 27 3 – 1 3 Designated components and costs of hedging within accumu- lated other equity changed as follows: 2024 2023 Currency risks Interest rate risk Combined interest / currency risk Raw material price risk Currency risks Interest rate risk Combined interest / currency risk Raw material price risk in € million Designated component Costs of hedging Costs of hedging Costs of hedging Designated component Costs of hedging Designated component Costs of hedging Costs of hedging Costs of hedging Designated component Costs of hedging Opening balance at 1 January 2,377 – 1,018 – – 2 – 1,206 – 2,026 – 1,783 – – 3 662 – Change in fair value during the reporting period – 679 99 – – 27 – 892 – 1,654 – 103 – 1 – 2,161 – Reclassification to profit or loss for continuing hedge relationships – 1,458 656 – – – – – 1,153 733 – – – – for terminated hedge relationships – 428 191 – – 151 – – 150 135 – – 2 – Reclassification to acquisition costs for inventories – – – – 785 – – – – – 291 – Closing balance at 31 December – 188 – 72 – – 29 – 1,162 – 2,377 – 1,018 – – 2 – 1,206 –

BMW Group Report 2024 Page 336 Page 338

BMW Group Report 2024 Page 336 Page 338