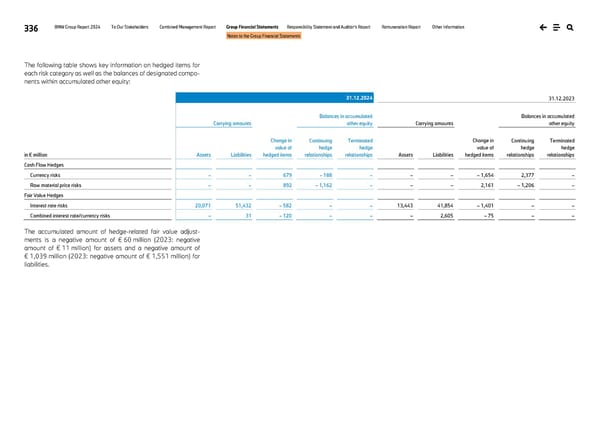

336 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements The following table shows key information on hedged items for each risk category as well as the balances of designated compo- nents within accumulated other equity: 31.12.2024 31.12.2023 Carrying amounts Change in value of hedged items Balances in accumulated other equity Carrying amounts Change in value of hedged items Balances in accumulated other equity in € million Assets Liabilities Continuing hedge relationships Terminated hedge relationships Assets Liabilities Continuing hedge relationships Terminated hedge relationships Cash Flow Hedges Currency risks – – 679 – 188 – – – – 1,654 2,377 – Raw material price risks – – 892 – 1,162 – – – 2,161 – 1,206 – Fair Value Hedges Interest rate risks 20,071 51,432 – 582 – – 13,443 41,854 – 1,401 – – Combined interest rate/currency risks – 31 – 120 – – – 2,605 – 75 – – The accumulated amount of hedge-related fair value adjust- ments is a negative amount of € 60 million (2023: negative amount of € 11 million) for assets and a negative amount of € 1,039 million (2023: negative amount of € 1,551 million) for liabilities.

BMW Group Report 2024 Page 335 Page 337

BMW Group Report 2024 Page 335 Page 337