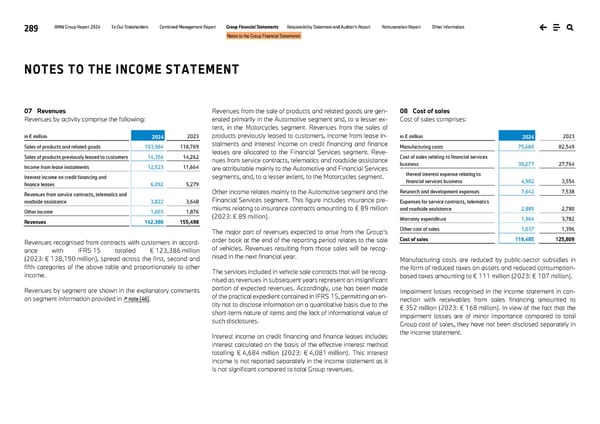

289 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements NOTES TO THE INCOME STATEMENT 07 Revenues Revenues by activity comprise the following: in € million 2024 2023 Sales of products and related goods 103,984 118,769 Sales of products previously leased to customers 14,356 14,262 Income from lease instalments 12,523 11,664 Interest income on credit financing and finance leases 6,092 5,279 Revenues from service contracts, telematics and roadside assistance 3,822 3,648 Other income 1,603 1,876 Revenues 142,380 155,498 Revenues recognised from contracts with customers in accord- ance with IFRS 15 totalled € 123,386 million (2023: € 138,190 million), spread across the first, second and fifth categories of the above table and proportionately to other income. Revenues by segment are shown in the explanatory comments on segment information provided in ↗ note [46]. Revenues from the sale of products and related goods are gen- erated primarily in the Automotive segment and, to a lesser ex- tent, in the Motorcycles segment. Revenues from the sales of products previously leased to customers, income from lease in- stalments and interest income on credit financing and finance leases are allocated to the Financial Services segment. Reve- nues from service contracts, telematics and roadside assistance are attributable mainly to the Automotive and Financial Services segments, and, to a lesser extent, to the Motorcycles segment. Other income relates mainly to the Automotive segment and the Financial Services segment. This figure includes insurance pre- miums relating to insurance contracts amounting to € 89 million (2023: € 89 million). The major part of revenues expected to arise from the Group’s order book at the end of the reporting period relates to the sale of vehicles. Revenues resulting from those sales will be recog- nised in the next financial year. The services included in vehicle sale contracts that will be recog- nised as revenues in subsequent years represent an insignificant portion of expected revenues. Accordingly, use has been made of the practical expedient contained in IFRS 15, permitting an en- tity not to disclose information on a quantitative basis due to the short-term nature of items and the lack of informational value of such disclosures. Interest income on credit financing and finance leases includes interest calculated on the basis of the effective interest method totalling € 4,684 million (2023: € 4,081 million). This interest income is not reported separately in the income statement as it is not significant compared to total Group revenues. 08 Cost of sales Cost of sales comprises: in € million 2024 2023 Manufacturing costs 75,680 82,549 Cost of sales relating to financial services business 30,277 27,764 thereof interest expense relating to financial services business 4,902 3,554 Research and development expenses 7,642 7,538 Expenses for service contracts, telematics and roadside assistance 2,885 2,780 Warranty expenditure 1,964 3,782 Other cost of sales 1,037 1,396 Cost of sales 119,485 125,809 Manufacturing costs are reduced by public-sector subsidies in the form of reduced taxes on assets and reduced consumption- based taxes amounting to € 111 million (2023: € 107 million). Impairment losses recognised in the income statement in con- nection with receivables from sales financing amounted to € 352 million (2023: € 168 million). In view of the fact that the impairment losses are of minor importance compared to total Group cost of sales, they have not been disclosed separately in the income statement.

BMW Group Report 2024 Page 288 Page 290

BMW Group Report 2024 Page 288 Page 290