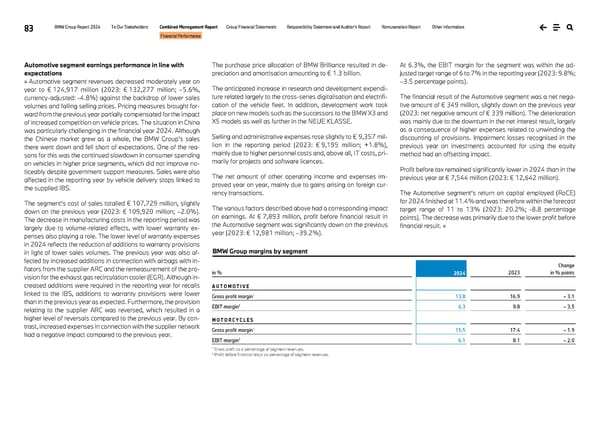

83 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance Automotive segment earnings performance in line with expectations » Automotive segment revenues decreased moderately year on year to € 124,917 million (2023: € 132,277 million; –5.6%, currency-adjusted: –4.8%) against the backdrop of lower sales volumes and falling selling prices. Pricing measures brought for- ward from the previous year partially compensated for the impact of increased competition on vehicle prices. The situation in China was particularly challenging in the financial year 2024. Although the Chinese market grew as a whole, the BMW Group’s sales there went down and fell short of expectations. One of the rea- sons for this was the continued slowdown in consumer spending on vehicles in higher price segments, which did not improve no- ticeably despite government support measures. Sales were also affected in the reporting year by vehicle delivery stops linked to the supplied IBS. The segment’s cost of sales totalled € 107,729 million, slightly down on the previous year (2023: € 109,920 million; –2.0%). The decrease in manufacturing costs in the reporting period was largely due to volume-related effects, with lower warranty ex- penses also playing a role. The lower level of warranty expenses in 2024 reflects the reduction of additions to warranty provisions in light of lower sales volumes. The previous year was also af- fected by increased additions in connection with airbags with in- flators from the supplier ARC and the remeasurement of the pro- vision for the exhaust gas recirculation cooler (EGR). Although in- creased additions were required in the reporting year for recalls linked to the IBS, additions to warranty provisions were lower than in the previous year as expected. Furthermore, the provision relating to the supplier ARC was reversed, which resulted in a higher level of reversals compared to the previous year. By con- trast, increased expenses in connection with the supplier network had a negative impact compared to the previous year. The purchase price allocation of BMW Brilliance resulted in de- preciation and amortisation amounting to € 1.3 billion. The anticipated increase in research and development expendi- ture related largely to the cross-series digitalisation and electrifi- cation of the vehicle fleet. In addition, development work took place on new models such as the successors to the BMW X3 and X5 models as well as further in the NEUE KLASSE. Selling and administrative expenses rose slightly to € 9,357 mil- lion in the reporting period (2023: € 9,195 million; +1.8%), mainly due to higher personnel costs and, above all, IT costs, pri- marily for projects and software licences. The net amount of other operating income and expenses im- proved year on year, mainly due to gains arising on foreign cur- rency transactions. The various factors described above had a corresponding impact on earnings. At € 7,893 million, profit before financial result in the Automotive segment was significantly down on the previous year (2023: € 12,981 million; –39.2%). 1 Gross profit as a percentage of segment revenues. 2 Profit before financial result as percentage of segment revenues. At 6.3%, the EBIT margin for the segment was within the ad- justed target range of 6 to 7% in the reporting year (2023: 9.8%; –3.5 percentage points). The financial result of the Automotive segment was a net nega- tive amount of € 349 million, slightly down on the previous year (2023: net negative amount of € 339 million). The deterioration was mainly due to the downturn in the net interest result, largely as a consequence of higher expenses related to unwinding the discounting of provisions. Impairment losses recognised in the previous year on investments accounted for using the equity method had an offsetting impact. Profit before tax remained significantly lower in 2024 than in the previous year at € 7,544 million (2023: € 12,642 million). The Automotive segment’s return on capital employed (RoCE) for 2024 finished at 11.4% and was therefore within the forecast target range of 11 to 13% (2023: 20.2%; –8.8 percentage points). The decrease was primarily due to the lower profit before financial result. « in % 2024 2023 Change in % points A U T O M O T I V E Gross profit margin1 13.8 16.9 – 3.1 EBIT margin2 6.3 9.8 – 3.5 M O T O R C Y C L E S Gross profit margin1 15.5 17.4 – 1.9 EBIT margin2 6.1 8.1 – 2.0 BMW Group margins by segment

BMW Group Report 2024 Page 82 Page 84

BMW Group Report 2024 Page 82 Page 84