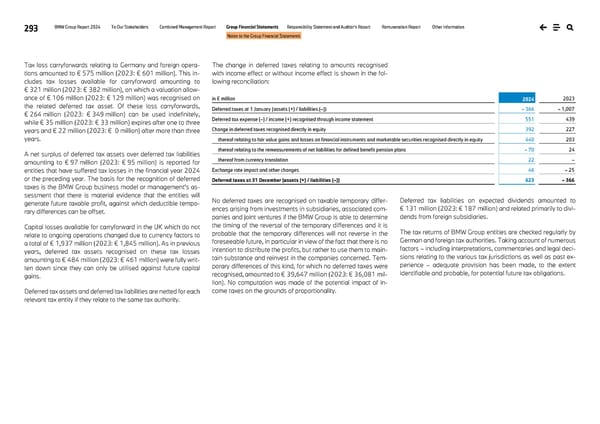

293 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Tax loss carryforwards relating to Germany and foreign opera- tions amounted to € 575 million (2023: € 601 million). This in- cludes tax losses available for carryforward amounting to € 321 million (2023: € 382 million), on which a valuation allow- ance of € 106 million (2023: € 129 million) was recognised on the related deferred tax asset. Of these loss carryforwards, € 264 million (2023: € 349 million) can be used indefinitely, while € 35 million (2023: € 33 million) expires after one to three years and € 22 million (2023: € 0 million) after more than three years. A net surplus of deferred tax assets over deferred tax liabilities amounting to € 97 million (2023: € 95 million) is reported for entities that have suffered tax losses in the financial year 2024 or the preceding year. The basis for the recognition of deferred taxes is the BMW Group business model or management's as- sessment that there is material evidence that the entities will generate future taxable profit, against which deductible tempo- rary differences can be offset. Capital losses available for carryforward in the UK which do not relate to ongoing operations changed due to currency factors to a total of € 1,937 million (2023: € 1,845 million). As in previous years, deferred tax assets recognised on these tax losses amounting to € 484 million (2023: € 461 million) were fully writ- ten down since they can only be utilised against future capital gains. Deferred tax assets and deferred tax liabilities are netted for each relevant tax entity if they relate to the same tax authority. The change in deferred taxes relating to amounts recognised with income effect or without income effect is shown in the fol- lowing reconciliation: No deferred taxes are recognised on taxable temporary differ- ences arising from investments in subsidiaries, associated com- panies and joint ventures if the BMW Group is able to determine the timing of the reversal of the temporary differences and it is probable that the temporary differences will not reverse in the foreseeable future, in particular in view of the fact that there is no intention to distribute the profits, but rather to use them to main- tain substance and reinvest in the companies concerned. Tem- porary differences of this kind, for which no deferred taxes were recognised, amounted to € 39,647 million (2023: € 36,081 mil- lion). No computation was made of the potential impact of in- come taxes on the grounds of proportionality. Deferred tax liabilities on expected dividends amounted to € 131 million (2023: € 187 million) and related primarily to divi- dends from foreign subsidiaries. The tax returns of BMW Group entities are checked regularly by German and foreign tax authorities. Taking account of numerous factors – including interpretations, commentaries and legal deci- sions relating to the various tax jurisdictions as well as past ex- perience – adequate provision has been made, to the extent identifiable and probable, for potential future tax obligations. in € million 2024 2023 Deferred taxes at 1 January (assets (+) / liabilities (–)) – 366 – 1,007 Deferred tax expense (–) / income (+) recognised through income statement 551 439 Change in deferred taxes recognised directly in equity 392 227 thereof relating to fair value gains and losses on financial instruments and marketable securities recognised directly in equity 440 203 thereof relating to the remeasurements of net liabilities for defined benefit pension plans – 70 24 thereof from currency translation 22 – Exchange rate impact and other changes 46 – 25 Deferred taxes at 31 December (assets (+) / liabilities (–)) 623 – 366

BMW Group Report 2024 Page 292 Page 294

BMW Group Report 2024 Page 292 Page 294