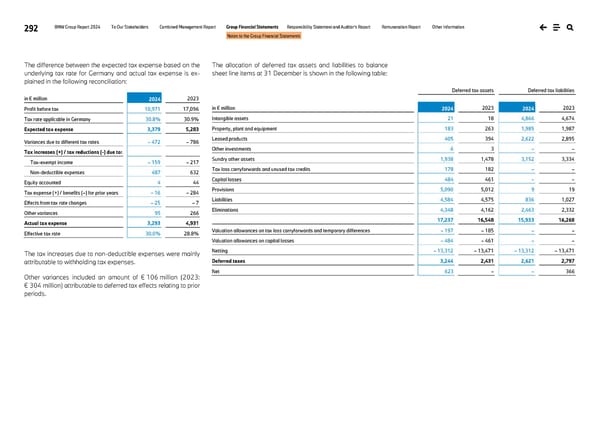

292 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements The difference between the expected tax expense based on the underlying tax rate for Germany and actual tax expense is ex- plained in the following reconciliation: in € million 2024 2023 Profit before tax 10,971 17,096 Tax rate applicable in Germany 30.8% 30.9% Expected tax expense 3,379 5,283 Variances due to different tax rates – 472 – 786 Tax increases (+) / tax reductions (-) due to: Tax-exempt income – 159 – 217 Non-deductible expenses 487 632 Equity accounted 4 44 Tax expense (+) / benefits (–) for prior years – 16 – 284 Effects from tax rate changes – 25 – 7 Other variances 95 266 Actual tax expense 3,293 4,931 Effective tax rate 30.0% 28.8% The tax increases due to non-deductible expenses were mainly attributable to withholding tax expenses. Other variances included an amount of € 106 million (2023: € 304 million) attributable to deferred tax effects relating to prior periods. The allocation of deferred tax assets and liabilities to balance sheet line items at 31 December is shown in the following table: Deferred tax assets Deferred tax liabilities in € million 2024 2023 2024 2023 Intangible assets 21 18 4,866 4,674 Property, plant and equipment 183 263 1,985 1,987 Leased products 405 394 2,622 2,895 Other investments 6 3 – – Sundry other assets 1,938 1,478 3,152 3,334 Tax loss carryforwards and unused tax credits 178 182 – – Capital losses 484 461 – – Provisions 5,090 5,012 9 19 Liabilities 4,584 4,575 836 1,027 Eliminations 4,348 4,162 2,463 2,332 17,237 16,548 15,933 16,268 Valuation allowances on tax loss carryforwards and temporary differences – 197 – 185 – – Valuation allowances on capital losses – 484 – 461 – – Netting – 13,312 – 13,471 – 13,312 – 13,471 Deferred taxes 3,244 2,431 2,621 2,797 Net 623 – – 366

BMW Group Report 2024 Page 291 Page 293

BMW Group Report 2024 Page 291 Page 293