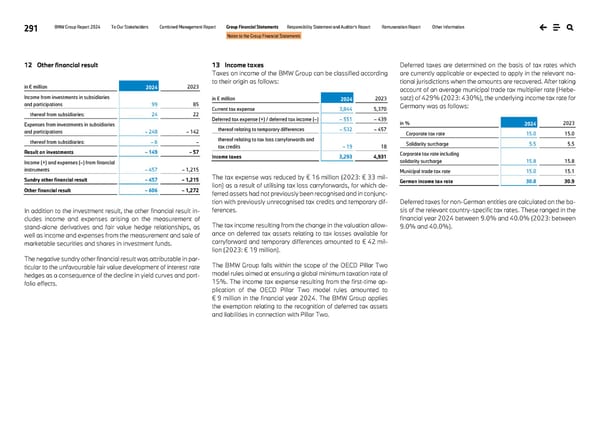

291 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 12 Other financial result in € million 2024 2023 Income from investments in subsidiaries and participations 99 85 thereof from subsidiaries: 24 22 Expenses from investments in subsidiaries and participations – 248 – 142 thereof from subsidiaries: – 6 – Result on investments – 149 – 57 Income (+) and expenses (–) from financial instruments – 457 – 1,215 Sundry other financial result – 457 – 1,215 Other financial result – 606 – 1,272 In addition to the investment result, the other financial result in- cludes income and expenses arising on the measurement of stand-alone derivatives and fair value hedge relationships, as well as income and expenses from the measurement and sale of marketable securities and shares in investment funds. The negative sundry other financial result was attributable in par- ticular to the unfavourable fair value development of interest rate hedges as a consequence of the decline in yield curves and port- folio effects. 13 Income taxes Taxes on income of the BMW Group can be classified according to their origin as follows: in € million 2024 2023 Current tax expense 3,844 5,370 Deferred tax expense (+) / deferred tax income (–) – 551 – 439 thereof relating to temporary differences – 532 – 457 thereof relating to tax loss carryforwards and tax credits – 19 18 Income taxes 3,293 4,931 The tax expense was reduced by € 16 million (2023: € 33 mil- lion) as a result of utilising tax loss carryforwards, for which de- ferred assets had not previously been recognised and in conjunc- tion with previously unrecognised tax credits and temporary dif- ferences. The tax income resulting from the change in the valuation allow- ance on deferred tax assets relating to tax losses available for carryforward and temporary differences amounted to € 42 mil- lion (2023: € 19 million). The BMW Group falls within the scope of the OECD Pillar Two model rules aimed at ensuring a global minimum taxation rate of 15%. The income tax expense resulting from the first-time ap- plication of the OECD Pillar Two model rules amounted to € 9 million in the financial year 2024. The BMW Group applies the exemption relating to the recognition of deferred tax assets and liabilities in connection with Pillar Two. Deferred taxes are determined on the basis of tax rates which are currently applicable or expected to apply in the relevant na- tional jurisdictions when the amounts are recovered. After taking account of an average municipal trade tax multiplier rate (Hebe- satz) of 429% (2023: 430%), the underlying income tax rate for Germany was as follows: in % 2024 2023 Corporate tax rate 15.0 15.0 Solidarity surcharge 5.5 5.5 Corporate tax rate including solidarity surcharge 15.8 15.8 Municipal trade tax rate 15.0 15.1 German income tax rate 30.8 30.9 Deferred taxes for non-German entities are calculated on the ba- sis of the relevant country-specific tax rates. These ranged in the financial year 2024 between 9.0% and 40.0% (2023: between 9.0% and 40.0%).

BMW Group Report 2024 Page 290 Page 292

BMW Group Report 2024 Page 290 Page 292